By Kathleen Madigan

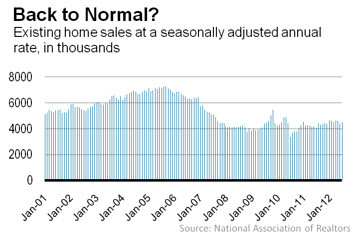

Housing continues its slow creep toward

stability. Normalcy is a long way off.

The National Association of Realtors announced July sales of existing homes

rose to an annual rate of 4.47 million, close to expectations.

Interestingly, the NAR says sales could be even

higher: “The market is constrained by unnecessarily tight lending standards and

shrinking inventory supplies, so housing could easily be much stronger without

these abnormal frictions.”

What would be normal? The NAR said current

demographics would support existing home sales in the 5.0-5.5 million range if

conditions were optimal.

But of course, conditions are not. First-time

and move-up buyers are restrained by tight lending standards and weak job

growth.

Investors are stepping into the breach. Their

purchases of homes reflect the shift from owning to renting among U.S.

In July, investors bought 16% of homes sold.

That’s on the low end of their share of sales over the past two years but

that’s not because of less interest.

Instead, it’s because speculators are finding

fewer bargains to buy. Distressed homes–foreclosures and short sales sold at

deep discounts–accounted for 24% of July sales, down from 29% a year earlier.

Fewer cheap homes, in turn, helped to push up

the median price of the existing homes sold. It rose to $187,000, a 9.4% jump

from year-ago levels. Better prices should draw more homes onto the market.

“Persistent news of a solid floor in home prices

should help the recovery in organic turnover as selling conditions continue to

improve,” say economists at Credit Suisse.

Sales are sales, so investor interest helps

overall housing demand. But the financial lift to the average U.S.

Since the jump in the NAR median price reflects

a change in the mix of homes sold, homeowners in a community with few

foreclosures aren’t seeing their home equity rising at nearly double-digit

rates. Home price indexes that adjust for housing mix are showing no gain in

prices.

Consequently, U.S.

However, expectations for only modest gains in

consumer spending is why a stable housing market is good news for an economy

that needs all the positive trends it can get.

For more information about sea Isle city real estate or Cape May County real estate check us out on line www.LandisCo.com .

Email us at info@LandisCo.com or toll free at (888)SEA-ISLE

No comments:

Post a Comment